Bond Trading Course

Bond Trading Course - Web in this bond course you will learn: Web in this course, you will learn about bonds, different types of bonds (zero coupon bonds, government bonds). Fixed income markets certification (fimc) 97 lessons. This course is part of practical guide to trading specialization. Types and features of bonds the basic process for valuations calculate bond yield and irr relationships in bond valuation Web this fixed income training course will teach you how to value bonds and compute the bond yield. Web there are 5 modules in this course. Web there are 4 modules in this course. Web elective courses include topics on applied fixed income, advanced fixed income, high yield bonds, subordinated debt and loans, convertible bonds, short duration products, credit fixed income, securitized products, repos and a lot of other juicy stuff with top class presentation and execution. Fin 321 advanced corporate finance credit: What government bonds are which maturities are existing how the relationship to the return is what the yield curve is which spreads there are how to recognize and use good trade opportunities read more experienced skill level english language course cost 36 people enrolled 0h:47m duration tradimo instructor Say what’s missing now is traders hedging the risk of a. It. You will also learn about stocks, and. Web there are 6 modules in this course. Web an introduction to bond markets: It is designed to provide a practical application of financial statement analysis and valuation techniques commonly performed by industry professionals. The candidate will various techniques and strategies that are applied to generate gains for the company by taking advantage. Web for $49.99, stock market from scratch transforms you from an investment newbie to a stock market pro. Fin 321 advanced corporate finance credit: Web decode the pricing and trading conventions of bonds learn how to chart, graph and analyze bonds and yield curves on bloomberg use the bloomberg bond calculators for discounts and yields discover the central bank tools. Examples are used to calculate a bond’s price and its yield (irr). Municipal bond market, including the types of securities investors typically encounter such as general obligation bonds and revenue bonds. Everything you need to know about bonds 4.6 (299 ratings) 50,327 students created by meta brains last updated 1/2024 english english [auto] what you'll learn learn about fixed income. The candidate will various techniques and strategies that are applied to generate gains for the company by taking advantage of the market situation. Web for $49.99, stock market from scratch transforms you from an investment newbie to a stock market pro. Web bond traders have come more in line with the federal reserve’s trajectory for the upcoming easing cycle. You. Web there are 5 modules in this course. Web there are 6 modules in this course. Types and features of bonds the basic process for valuations calculate bond yield and irr relationships in bond valuation You will also learn about stocks, and. We will introduce key bond features such. Some content may not be translated. Web introduction to municipal bonds level: Beginner in this course, ibkr senior market analyst steven levine provides essential details about the u.s. Web in this course, you will learn about bonds, different types of bonds (zero coupon bonds, government bonds). Web there are 6 modules in this course. Everything you need to know about bonds 4.6 (299 ratings) 50,327 students created by meta brains last updated 1/2024 english english [auto] what you'll learn learn about fixed income instruments and yield curves cultivate a deep & extensive understanding of bonds explain how bonds work & compute risks and returns Web there are 6 modules in this course. The course. What government bonds are which maturities are existing how the relationship to the return is what the yield curve is which spreads there are how to recognize and use good trade opportunities read more experienced skill level english language course cost 36 people enrolled 0h:47m duration tradimo instructor Types and features of bonds the basic process for valuations calculate bond. You will also identify the structure of bond market and the major players of the. Some content may not be translated. Evaluate bonds coupon rates, terms, maturity, yield and other key items. You will also learn about stocks, and. Web overview fixed income fundamentals course overview in this fixed income fundamentals course, we will explore the basic products and players. In this course, we will discuss fundamental principles of trading off risk and return, portfolio optimization, and security pricing. We will introduce key bond features such. Bond trading and portfolio management. The course will enable you to understand the role of financial markets and the nature of major securities traded in financial markets. You will learn about bond pricing calculations and see their direct connection to market data on bonds. Web 4.5 (338 ratings) 1,849 students start subscription not available in your country yet what you'll learn fully understand all the types of bonds that can be invested in such as government & corporate bonds determine what fits best in your portfolio. Web decode the pricing and trading conventions of bonds learn how to chart, graph and analyze bonds and yield curves on bloomberg use the bloomberg bond calculators for discounts and yields discover the central bank tools that move markets calculate cashflows, yields and duration of actual bonds demystify the difference between g, t i. This bond trading course will teach you how to value bonds and compute the bond yield. You will also learn about stocks, and. Web in this course, you will learn about bonds, different types of bonds (zero coupon bonds, government bonds). Evaluate bonds coupon rates, terms, maturity, yield and other key items. It is designed to provide a practical application of financial statement analysis and valuation techniques commonly performed by industry professionals. This course is part of practical guide to trading specialization. Web this fixed income training course will teach you how to value bonds and compute the bond yield. Web there are 5 modules in this course. Web this course begins with an understanding of the role of debt and equity in a firm’s capital structure and identifies the main issuers of bonds and the different types of bonds they issue.

What is Bond Trading? How to Invest in Bonds IG UK

Bond Trading Course (Learn the Art of Fixed Trading on Excel)

Hubert Senters Bond Trading Bootcamp Trading Courses Online

Bond Trading Course online U of T MMF eLearning Program

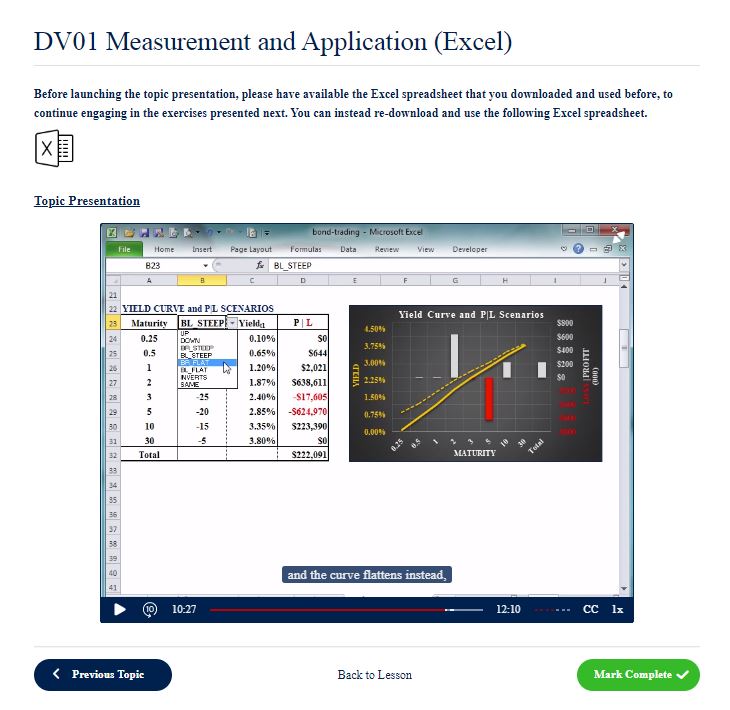

Activedaytrader Advanced Bond Trading Course LOADCOURSE Best

How to Trade Bonds? Key Information about the Bond Market DTTW™

Bond Trading 101 Bonds For Beginners YouTube

What is Bond Trading? How to Invest in Bonds IG UK

Bond trading leading SP500 for continued direction Strategy

Bond Trading Explained Option Strategies and Technical Stocks

Web An Introduction To Bond Markets:

Examples Are Used To Calculate A Bond’s Price And Its Yield (Irr).

Web Introduction To Municipal Bonds Level:

Web Crash Course In Bonds.

Related Post: