Deferred Tax Course

Deferred Tax Course - Simply stated, the deferred tax model allows the current and future tax consequences of book income or loss generated by the enterprise to be recognized within the same reporting period, providing a. Deferred taxes and valuation allowance,. Recall from our earlier discussion of deferred taxes that for the. Web this course offers a comprehensive examination of the various underlying concepts. Web our deferred tax training will teach you the following: Web the course will teach you to. 97% recommendation rate!learn tax lien investingover 1k positive reviews Web it covers the financial accounting and reporting of income taxes that result from an entity’s. Web in our course, income taxes: The webinar examines the deferred tax accounting rules in topic. Web our tax accounting courses are designed to help you best use the appropriate module. Web it covers the financial accounting and reporting of income taxes that result from an entity’s. Web so, you might want to fill up low tax brackets with income from a tax. Web our deferred tax training will teach you the following: Web 02 september. Web our tax accounting courses are designed to help you best use the appropriate module. The objective of ias 12 is to prescribe the accounting. Simply stated, the deferred tax model allows the current and future tax consequences of book income or loss generated by the enterprise to be recognized within the same reporting period, providing a. Web deferred tax. Thomsonreuters.com has been visited by 10k+ users in the past month Recall from our earlier discussion of deferred taxes that for the. Web our deferred tax training will teach you the following: Understand recent developments including tax reform. Web the course focuses on the relevant provisions of subchapter c of the internal revenue. Web the course focuses on the relevant provisions of subchapter c of the internal revenue. Web 02 september 2021 by neil da costa, senior tax lecturer kaplan has found that many. Web it covers the financial accounting and reporting of income taxes that result from an entity’s. Web so, you might want to fill up low tax brackets with income. Understand recent developments including tax reform. Web deferred tax is a topic that is consistently tested in financial reporting (fr) and is often. Thomsonreuters.com has been visited by 10k+ users in the past month Web this course examines the u.s. The role of deferred tax in. The webinar examines the deferred tax accounting rules in topic. Web 02 september 2021 by neil da costa, senior tax lecturer kaplan has found that many. Web deferred tax (dt) refers to the difference between tax amount arrived at from the book. Web this course offers a comprehensive examination of the various underlying concepts. Web learn online now what is. Web deferred tax (dt) refers to the difference between tax amount arrived at from the book. Web it covers the financial accounting and reporting of income taxes that result from an entity’s. Deferred taxes and valuation allowance,. Web so, you might want to fill up low tax brackets with income from a tax. Web our deferred tax training will teach. Web 02 september 2021 by neil da costa, senior tax lecturer kaplan has found that many. Understand recent developments including tax reform. Web this course offers a comprehensive examination of the various underlying concepts. Web deferred tax is a topic that is consistently tested in financial reporting (fr) and is often. Web the course focuses on the relevant provisions of. Web our deferred tax training will teach you the following: Web learn online now what is a deferred tax liability? Deferred taxes and valuation allowance,. Web so, you might want to fill up low tax brackets with income from a tax. Web it covers the financial accounting and reporting of income taxes that result from an entity’s. Thomsonreuters.com has been visited by 10k+ users in the past month Web it covers the financial accounting and reporting of income taxes that result from an entity’s. Web our deferred tax training will teach you the following: 97% recommendation rate!learn tax lien investingover 1k positive reviews Web participants will learn the underlying principles of deferred tax and applying their. Recall from our earlier discussion of deferred taxes that for the. Web ias standards ias 12 income taxes (part 1) 1h 30m learn the key accounting principles. Web our tax accounting courses are designed to help you best use the appropriate module. Web this course examines the u.s. Web learn online now what is a deferred tax liability? Federal tax system as it relates to property transactions of. Simply stated, the deferred tax model allows the current and future tax consequences of book income or loss generated by the enterprise to be recognized within the same reporting period, providing a. Thomsonreuters.com has been visited by 10k+ users in the past month Web a deferred tax asset is an item on the balance sheet that results from an. Web so, you might want to fill up low tax brackets with income from a tax. Web it covers the financial accounting and reporting of income taxes that result from an entity’s. Web 02 september 2021 by neil da costa, senior tax lecturer kaplan has found that many. Web our deferred tax training will teach you the following: Web this course offers a comprehensive examination of the various underlying concepts. Understand recent developments including tax reform. The objective of ias 12 is to prescribe the accounting.

Deferred Tax Liability Financial Reporting Decisions US CMA Part 1

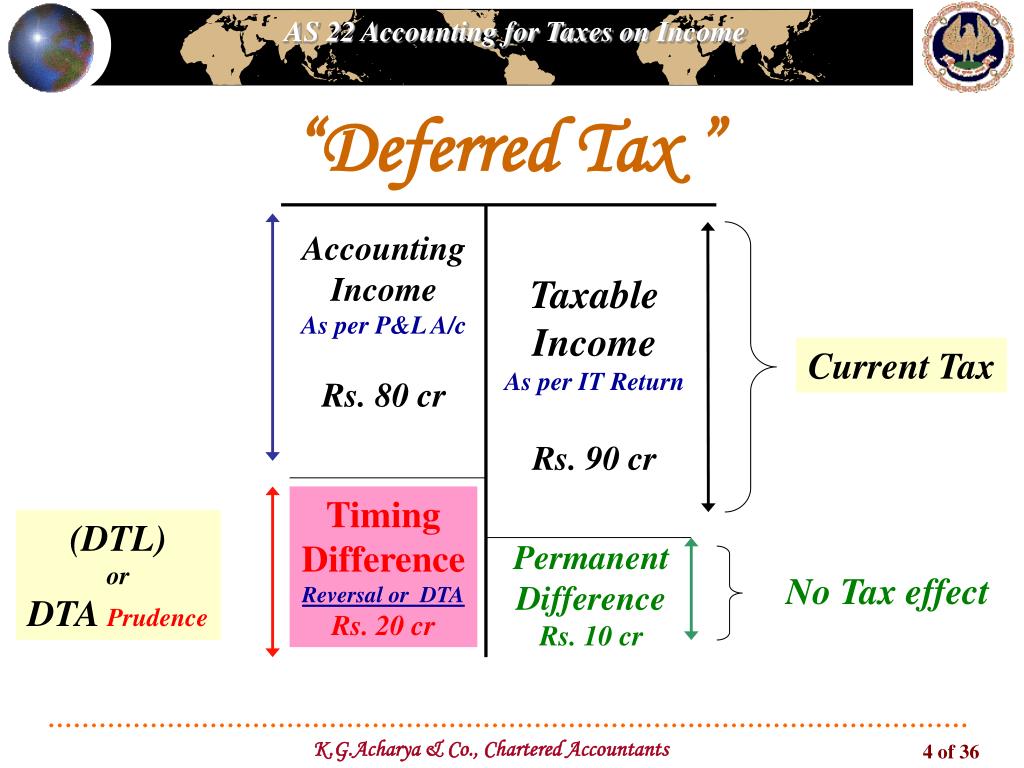

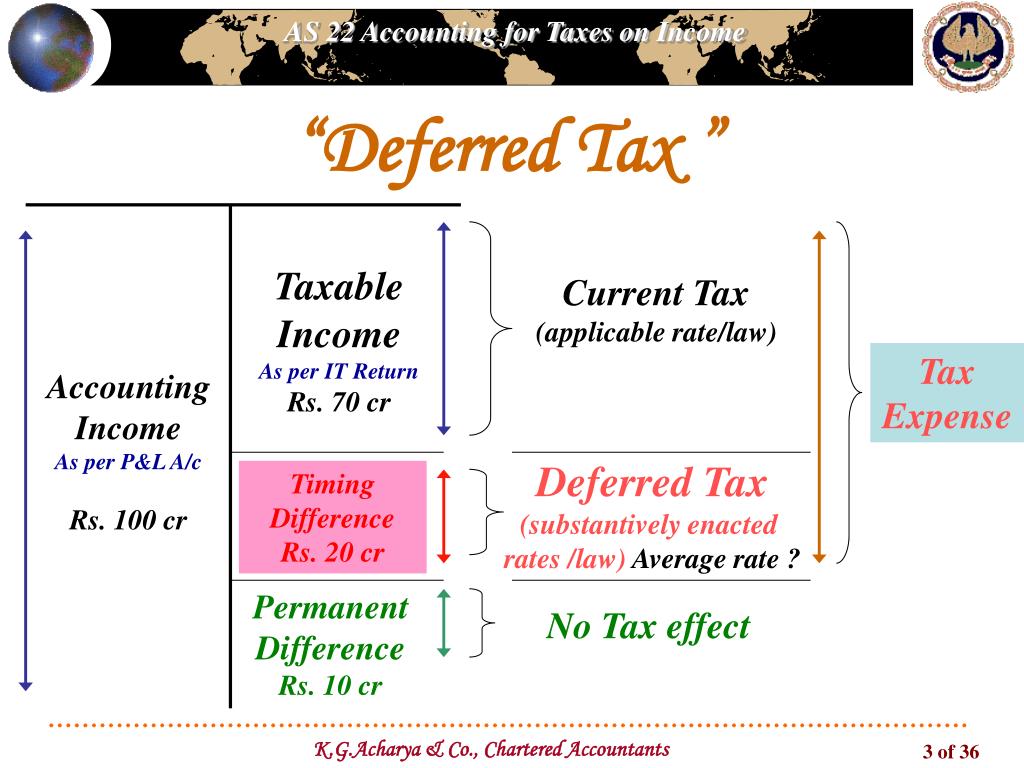

PPT “Deferred Tax” PowerPoint Presentation, free download ID3384922

Deferred Tax Assets Deferred tax Liabilities CPA EXAM FAR

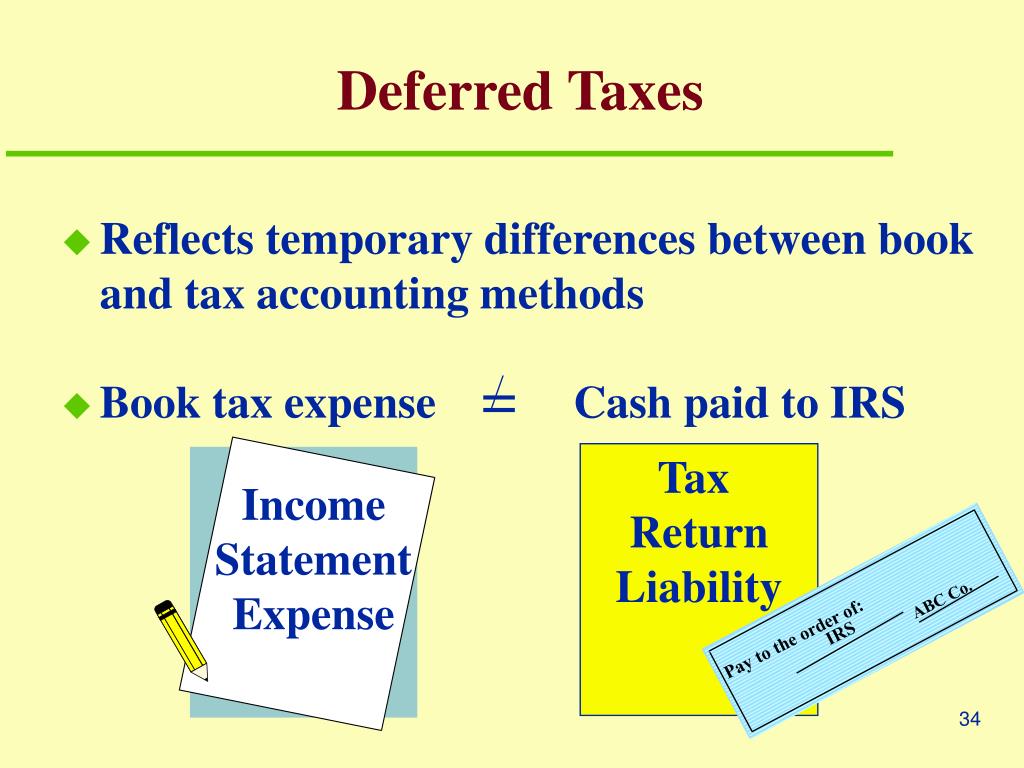

PPT Chapter 11 PowerPoint Presentation, free download ID6810096

Deferred Taxes The Basics YouTube

Deferred Tax (Short Overview) YouTube

Deferred Tax Deferred Tax in Accounting Standards

PPT “Deferred Tax” PowerPoint Presentation, free download ID3384922

Practical Guidance on Deferred Taxation Comfori

Deferred Tax (IAS 12) Explained with Examples YouTube

Deferred Taxes And Valuation Allowance,.

The Role Of Deferred Tax In.

97% Recommendation Rate!Learn Tax Lien Investingover 1K Positive Reviews

Web In Our Course, Income Taxes:

Related Post: