Fixed Income Course

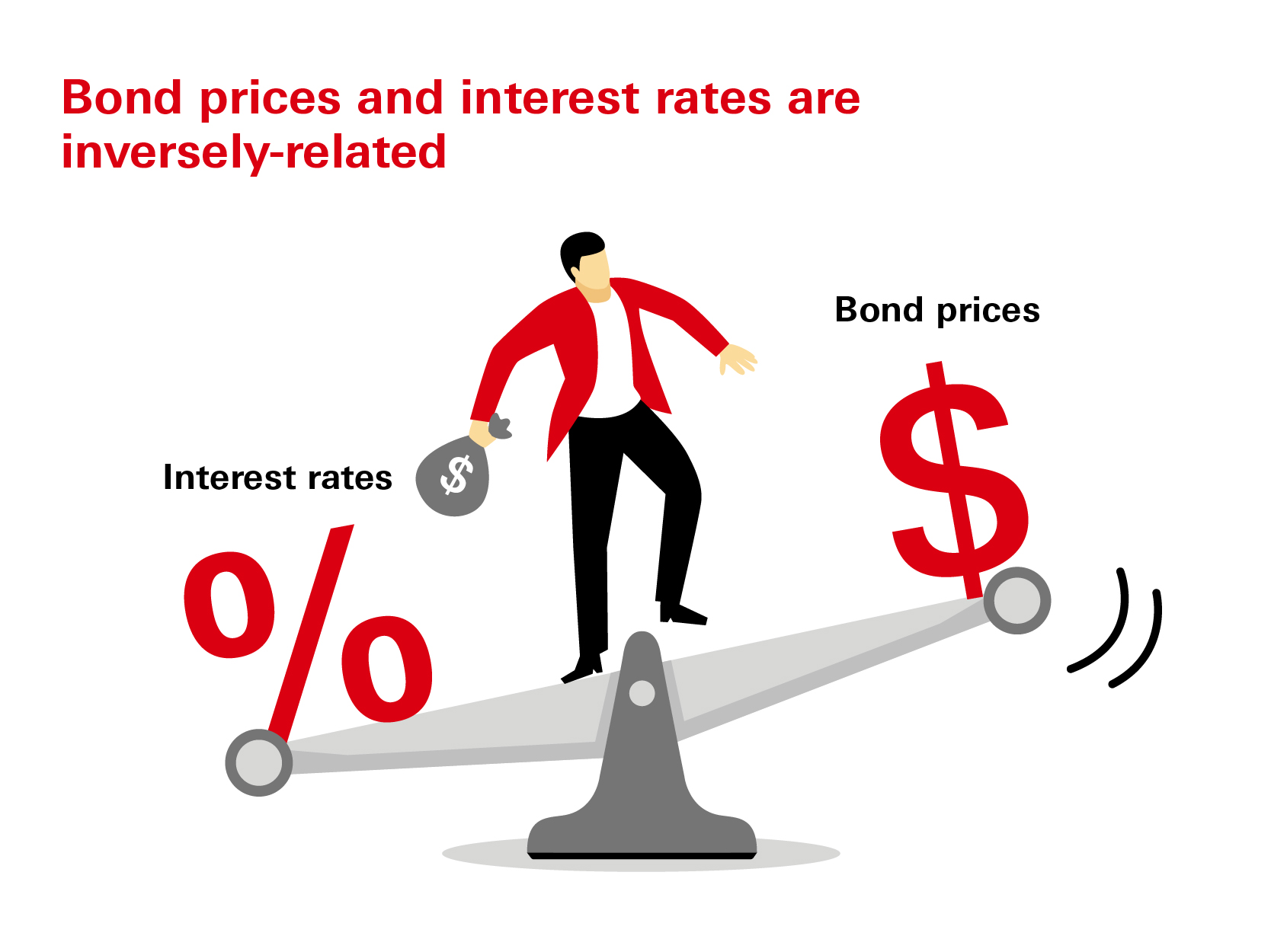

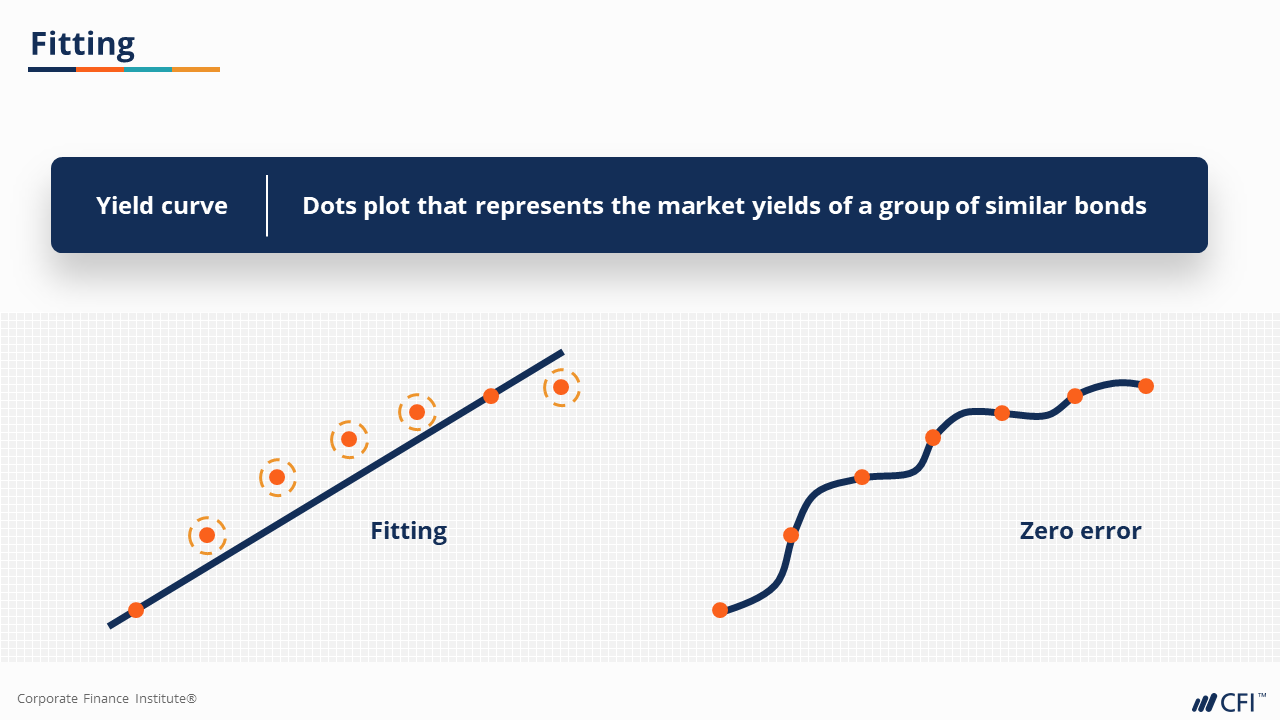

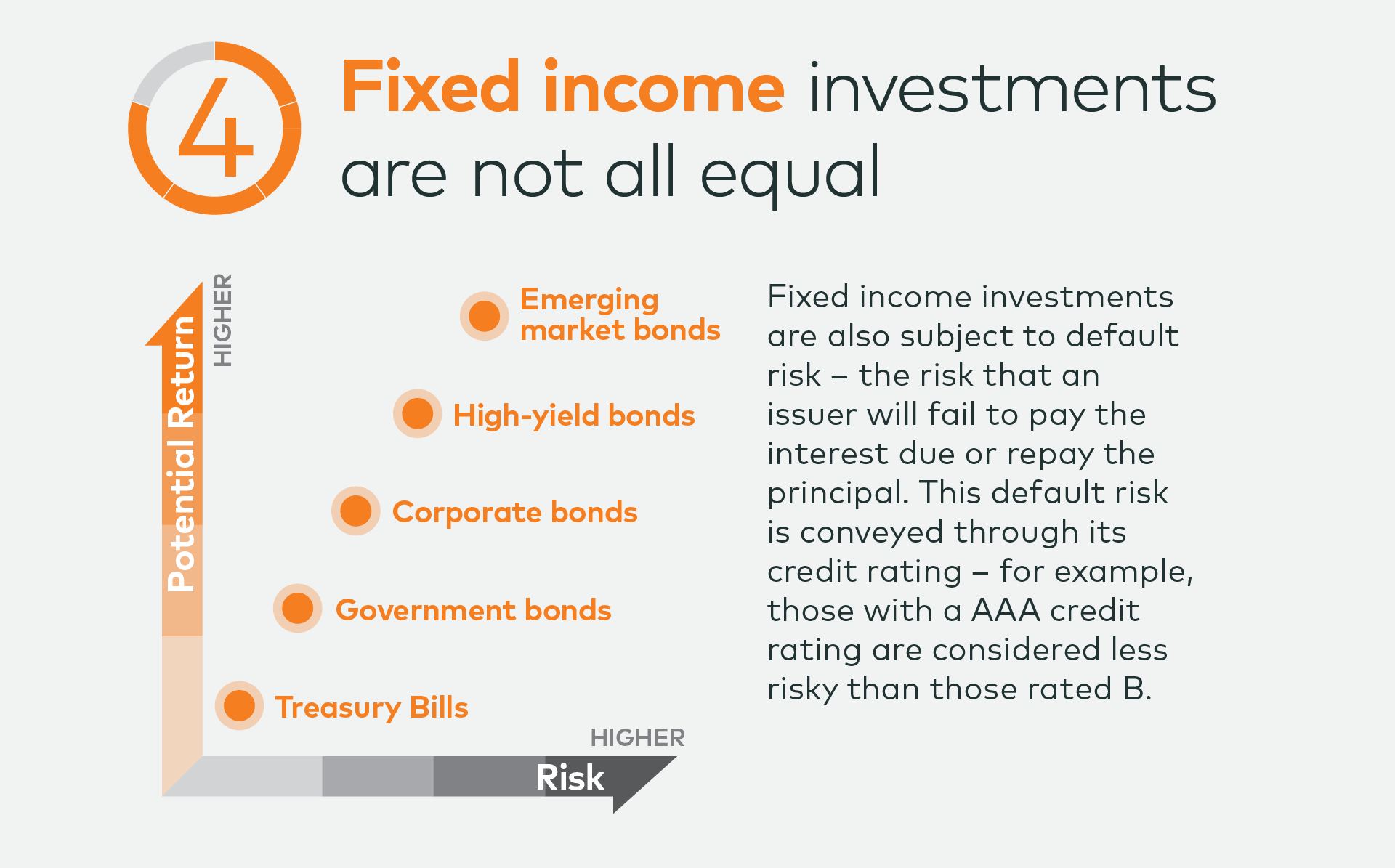

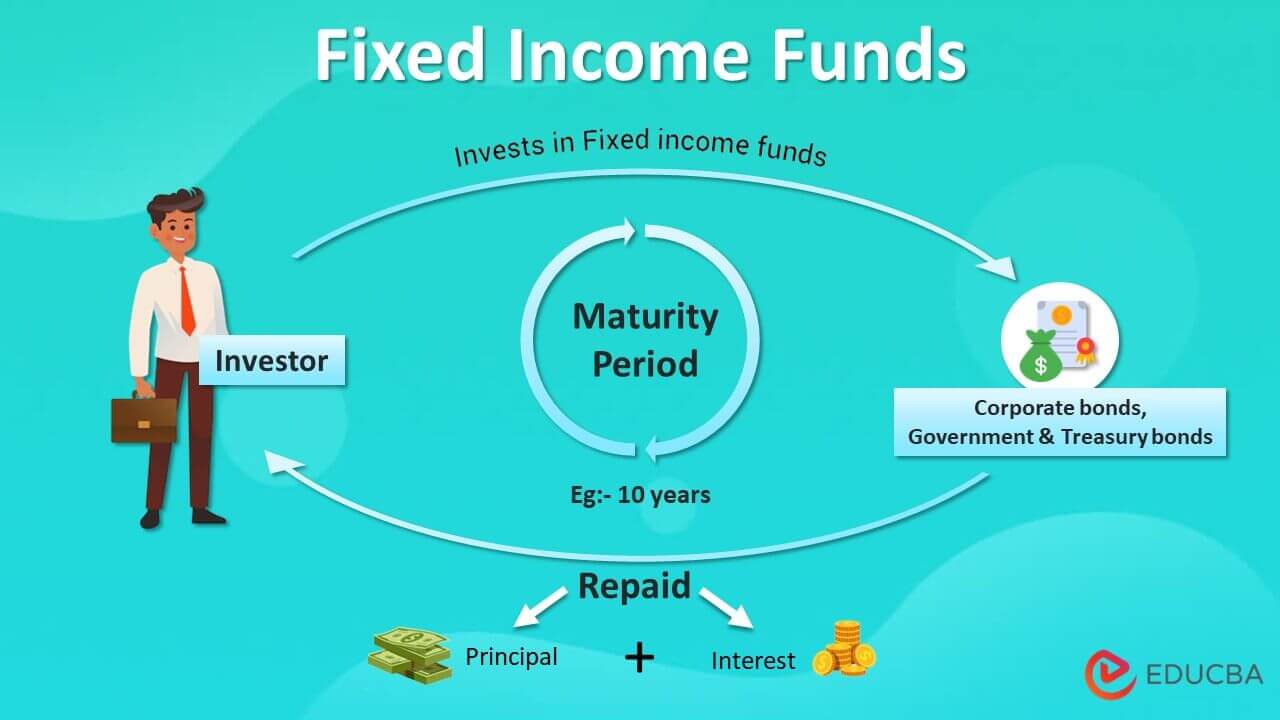

Fixed Income Course - Web description this course will introduce you to the market for bonds and fixed income securities, provide you with a lot of details on the characteristics of fixed income securities in general, as well as discuss specific characteristics of specific sectors and products within the fixed income markets, including the players. Everything you need to know about bonds 4.6 (299 ratings) 50,327 students created by meta brains last updated 1/2024 english english [auto] what you'll learn learn about fixed income instruments and yield curves Web the icma fixed income certificate (fic) is a professional qualification that places strong emphasis on practical skills, based on a thorough understanding of valuation principles and the relationships between the cash and derivatives markets. Web the course also provides participants with a refresher on fixed income and the risks associated with that instrument in particular. We discuss the main fixed income investors and how they are different have different objectives and risk tolerances. See here for a visual guide on how to do this. Web it is ideal for analysts or interns looking to break into debt capital market roles, bond trading, or other fixed income related roles. Our courses develop your skills from the fundamentals of fixed income through to advanced topics, ideal for students and seasoned professionals alike. Web discuss risks from fixed income securities; Web the fixed income course will help you to explore the realm of fixed income investments. Describe how primary and secondary bond markets work. Web graduate students must enroll in hadm 6270. Web the course also provides participants with a refresher on fixed income and the risks associated with that instrument in particular. Web in this fixed income investments course, we: This thorough and interactive course offers students like you, a detailed grounding in the full. Guide you through the various types of bonds. We will explore what is credit fixed income and the nuances of corporate bonds, as well as examine many of the measures of the additional yield that credit products provide. Em debt macro and market. Web graduate students must enroll in hadm 6270. Then, we will calculate the price of a bond. We discuss the main fixed income investors and how they are different have different objectives and risk tolerances. Illustrate the principles of bond pricing; We will explore what is credit fixed income and the nuances of corporate bonds, as well as examine many of the measures of the additional yield that credit products provide. Our courses develop your skills from. Web this course is designed to equip anyone who desires to begin a career in the capital markets on a fixed income desk or prepare for career advancement from junior to more senior fixed income trading or sales positions. Web description this course will introduce you to the market for bonds and fixed income securities, provide you with a lot. Describe how primary and secondary bond markets work. See here for a visual guide on how to do this. Web the course also provides participants with a refresher on fixed income and the risks associated with that instrument in particular. The course starts with an introduction to capital markets including issuance risks, regulations and valuations. Illustrate the principles of bond. Trading strategies used in the finance and capital markets. Web this course covers fixed income securities (including fixed income derivatives) and provides an introduction to the markets in which they are traded, as well as to the tools that are used to value these securities and to assess and manage their risk. Trading frequency and the framework for valuation are. The goals of the course are threefold: Learn fixed income securities today: Trading frequency and the framework for valuation are presented by use of an example involving a coupon bond. Em debt macro and market. Web the icma fixed income certificate (fic) is a professional qualification that places strong emphasis on practical skills, based on a thorough understanding of valuation. Trading frequency and the framework for valuation are presented by use of an example involving a coupon bond. Learn fixed income securities today: Illustrate the principles of bond pricing; The choice is yours 2023 was one of the worst i have ever had at the same time. Introduction to market infrastructure a broad overview of the roles, products, processes and. We will explore what is credit fixed income and the nuances of corporate bonds, as well as examine many of the measures of the additional yield that credit products provide. Guide you through the various types of bonds. Web the fixed income course will help you to explore the realm of fixed income investments. Web applied fixed income is part. Everything you need to know about bonds 4.6 (299 ratings) 50,327 students created by meta brains last updated 1/2024 english english [auto] what you'll learn learn about fixed income instruments and yield curves Become a bond analyst & investor an introduction to bond markets: Web in this fixed income investments course, we: The choice is yours 2023 was one of. Find your fixed income securities online course on udemy. Illustrate the principles of bond pricing; Calculate the cash flow from a bond; Web it is ideal for analysts or interns looking to break into debt capital market roles, bond trading, or other fixed income related roles. Describe how primary and secondary bond markets work. Web fixed income portfolio management is a comprehensive survey of the key drivers and features of managing a portfolio of fixed income assets. The goals of the course are threefold: The course starts with an introduction to capital markets including issuance risks, regulations and valuations. Illustrate what bond indenture, covenants, and contingency provisions are. Web this course is designed to equip anyone who desires to begin a career in the capital markets on a fixed income desk or prepare for career advancement from junior to more senior fixed income trading or sales positions. Em debt macro and market. Calculate bond prices, duration and convexity. Web in this fixed income course, you will learn to distinguish between different types of u.s. Web the fixed income course will help you to explore the realm of fixed income investments. Web in this credit fixed income course, we will introduce key concepts for credit analysts, investors, and traders. Web in this fixed income fundamentals course, we will explore the basic products and players in fixed income markets.

Fixed 101 HSBC Asset Management Hongkong

Model Fixed Portfolio Case Study

Fixed Course (9 Courses Bundle, Online Certification)

Advanced Fixed I Finance Course I CFI

Fixed Career Career in Fixed (Responsibility, Education)

5 facts about fixed AGF Perspectives

Fixed Certificate Online Pro Training Solutions Institute Of

How Does Fixed Work Independent Financial Services

Fixed Funds Features and Types of Fixed Funds

Fixed Securities Course Ceylon Exchange Mentoring Academy

We Discuss The Main Fixed Income Investors And How They Are Different Have Different Objectives And Risk Tolerances.

(1) To Develop The Set Of Tools Required To Evaluate Virtually Any Fixed Income Instrument;

Web The Course Also Provides Participants With A Refresher On Fixed Income And The Risks Associated With That Instrument In Particular.

There Is Also A Focus Bond Structuring, Pricing And On Credit Derivatives.

Related Post: