Payroll Accounting Course

Payroll Accounting Course - Web in payroll accounting, students learn to manage and process payroll for companies, organizations, and businesses. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. One of these is earning a high school diploma or general. Read reviews to decide if a class is right for you. Web payroll tax and accounting mgmt x 427.13 this course provides a fundamental introduction to the complexities and responsibilities of payroll tax laws, forms, and accounting. Getting it right the first time accounting for income taxes under asc 740: Bookkeeper, accounting clerk, accounts payable specialist Web learn how to use payroll accounting to keep track of wages, benefits and taxes in this free online bookkeeping course. Introduction to payroll and employees. The calculation, management, recording, and analysis of employees’ compensation. Being able to understand this language allows individuals both inside and outside of an organization to join the “conversation” about how the organization is performing and how it can improve future performance. Micromasters® program in accounting by indiana university (edx) 5. Introduction to payroll and employees. Web payroll tax and accounting mgmt x 427.13 this course provides a fundamental introduction. If a scheduling conflict arises, you are free to take a term off and won’t be charged during that term. Emphasizes applying payroll laws and regulations, computing wages, salaries, and payroll tax liabilities, preparing payroll reports and maintaining payroll records. Federal taxation as applied to individuals and businesses. This bookkeeping course lays out the fundamentals of payroll accounting. Fundamentals of. Accounting is the “language of business.”. We start with a brief overview of payroll accounting. Web home courses accounting & finance training payroll course get an understanding of payroll processes, regulations, and compliance requirements improve your understanding on health insurance, retirement plans, etc learn the crucial intricacies of payroll management with our payroll course dates & prices download syllabus payroll.. Led by an experienced cpa, this course offers practical examples and valuable insights into the intricacies of payroll processing. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. Web course #10101135 type post secondary credits 3.00 subject accounting introduces various payroll laws, payroll accounting systems, and procedures. Meet the educational requirements before you can take. Web some courses of interest to payroll accounting professionals may include: Financial accounting fundamentals by university of virginia (coursera) 3. Web using the pay statement as our roadmap, this course covers the basics of payroll that everyone who receives a paycheck should know. View course options read more about this course fall winter spring summer remote starting at $855.00 as. Web certification prep to demonstrate your mastery of payroll operations and compliance, earn one of the two payroll certifications payrollorg offers. Being able to understand this language allows individuals both inside and outside of an organization to join the “conversation” about how the organization is performing and how it can improve future performance. The calculation, management, recording, and analysis of. Web using the pay statement as our roadmap, this course covers the basics of payroll that everyone who receives a paycheck should know. We start with a brief overview of payroll accounting. Accounting is the “language of business.”. View course options read more about this course fall winter spring summer remote starting at $855.00 as few as 11 weeks 4.0. Federal taxation as applied to individuals and businesses. Led by an experienced cpa, this course offers practical examples and valuable insights into the intricacies of payroll processing. Fundamentals of accounting specialization by university of illinois (coursera) 4. The calculation, management, recording, and analysis of employees’ compensation. Enrollees also learn how to prepare and file payroll reports. Putting your procedures into writing Web home courses accounting & finance training payroll course get an understanding of payroll processes, regulations, and compliance requirements improve your understanding on health insurance, retirement plans, etc learn the crucial intricacies of payroll management with our payroll course dates & prices download syllabus payroll. Web payroll accounting courses and certifications. Web the diploma in. We start with a brief overview of payroll accounting. Accounting is the “language of business.”. This bookkeeping course lays out the fundamentals of payroll accounting. Financial accounting fundamentals by university of virginia (coursera) 3. Meet the educational requirements before you can take the fundamental payroll certification (fpc) exam, you must meet the apa's educational requirements. Review of the basics and recent developments creating a payroll manual: Web certification prep to demonstrate your mastery of payroll operations and compliance, earn one of the two payroll certifications payrollorg offers. Led by an experienced cpa, this course offers practical examples and valuable insights into the intricacies of payroll processing. Micromasters® program in accounting by indiana university (edx) 5. View course options read more about this course fall winter spring summer remote starting at $855.00 as few as 11 weeks 4.0 what you can learn. Led by an experienced cpa, this course offers practical examples and valuable insights into the intricacies of payroll processing. Enrollees also learn how to prepare and file payroll reports. Web home courses accounting & finance training payroll course get an understanding of payroll processes, regulations, and compliance requirements improve your understanding on health insurance, retirement plans, etc learn the crucial intricacies of payroll management with our payroll course dates & prices download syllabus payroll. Introduction to finance, accounting, modeling and valuation (udemy) 6. Federal taxation as applied to individuals and businesses. We then walk through an example of recording journal entries for payroll transactions and accruals for a month. We will discuss debits, credits, liabilities, and assets. Emphasizes applying payroll laws and regulations, computing wages, salaries, and payroll tax liabilities, preparing payroll reports and maintaining payroll records. The fundamental payroll certification (fpc) signifies a baseline knowledge of payroll while the certified payroll professional (cpp) certification shows mastery. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. Web this course prepares the learner with the basic knowledge needed to administer the accounting for payroll.

Payroll Accounting using Xero Learn Now Publications

Payroll with QuickBooks Online Payroll Training Course NACPB

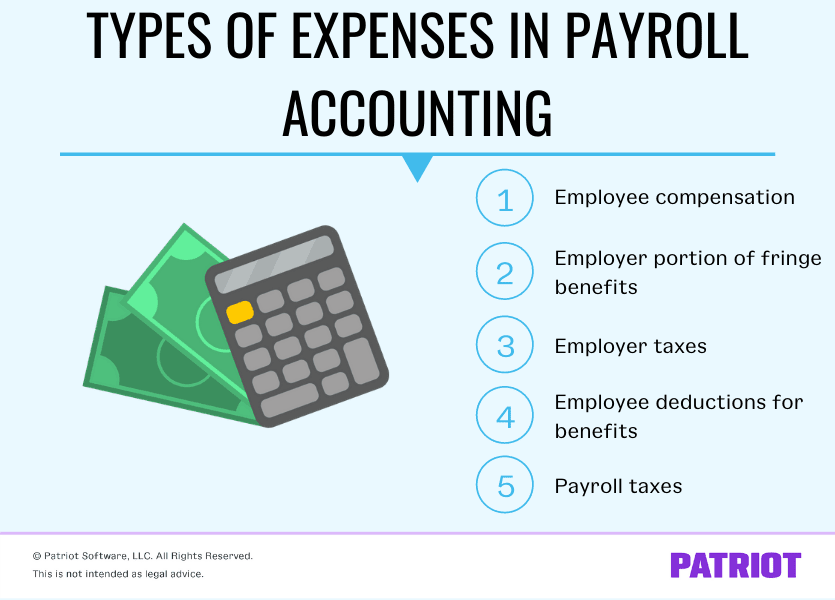

What Is Payroll Accounting? How to Do Payroll Journal Entries

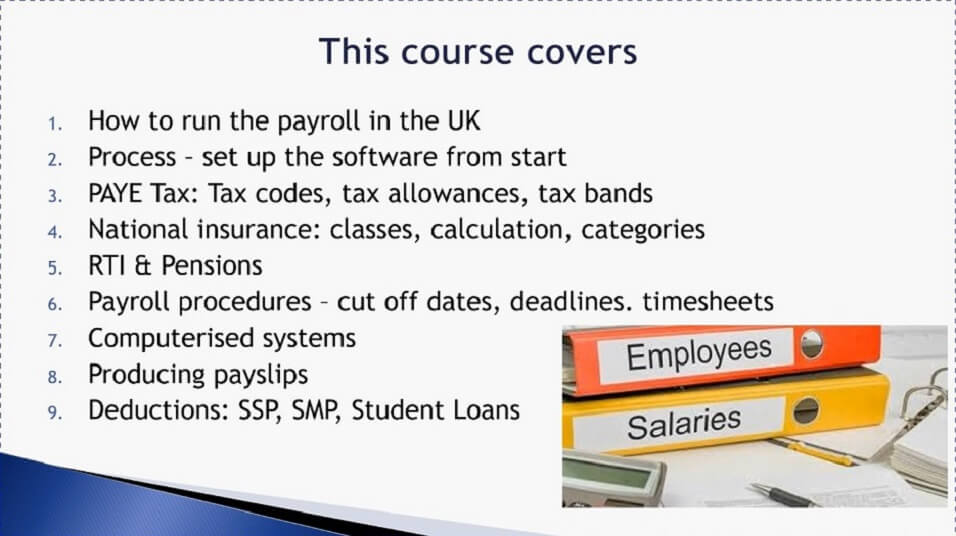

Payroll Management Online Course Institute of Accountancy

Payroll Accounting Lesson Plan 4.2 Course Title Session Title

ACCT 032 Payroll Accounting Simple Book Production

Payroll Accounting Book (Paperback)

10 Compelling Reasons to Enroll in an Accounting and Payroll Course

Accounting for Payroll Course QBOchat

Payroll Management Online Course Institute of Accountancy

If A Scheduling Conflict Arises, You Are Free To Take A Term Off And Won’t Be Charged During That Term.

Meet The Educational Requirements Before You Can Take The Fundamental Payroll Certification (Fpc) Exam, You Must Meet The Apa's Educational Requirements.

This Bookkeeping Course Lays Out The Fundamentals Of Payroll Accounting.

Introduction To Payroll And Employees.

Related Post: